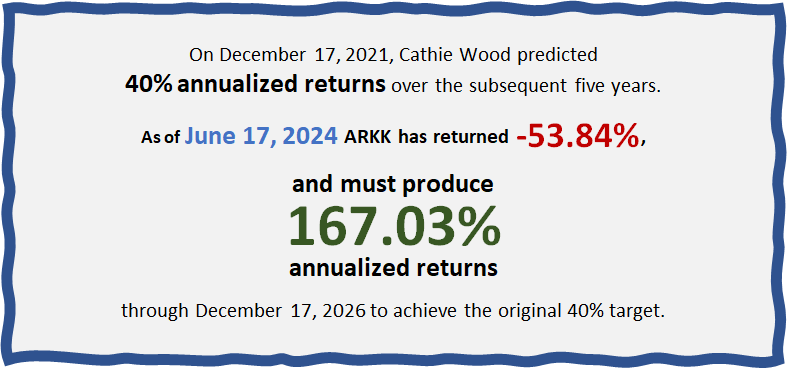

“Cathie Wood’s Prediction at the Halfway Mark” on Advisor Perspectives

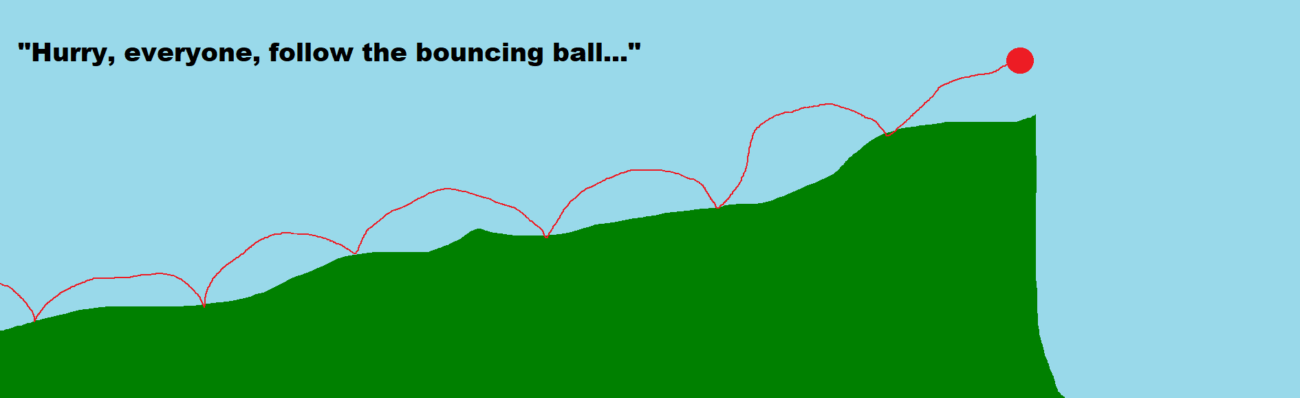

It’s tempting to say “the image says it all.” But there’s a whole Advisor Perspectives article because there are more insights to be gleaned from this example.

It’s tempting to say “the image says it all.” But there’s a whole Advisor Perspectives article because there are more insights to be gleaned from this example.

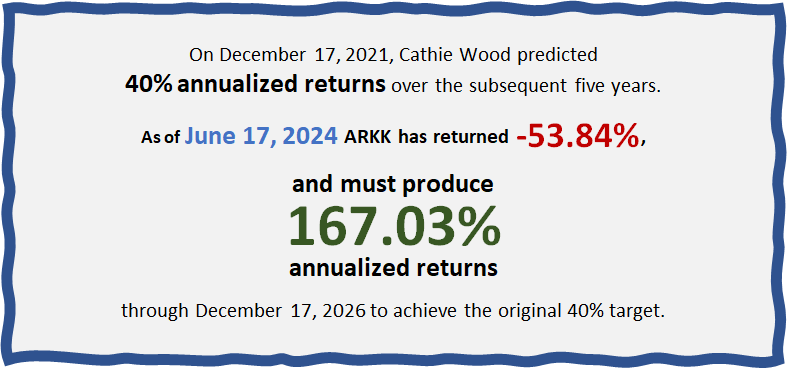

In Part 4, we get practical, demonstrating how discoveries from previous articles can be applied to a goals-based investment approach in retirement.

Part 2 of “Long-Horizon Investing” on Advisor Perspectives takes a tour of the theoretical reasons why stocks must be risky at all horizons.

I’m excited to announce the publication on Advisor Perspectives of the first article in a five-part series entitled “Long-Horizon Investing”!

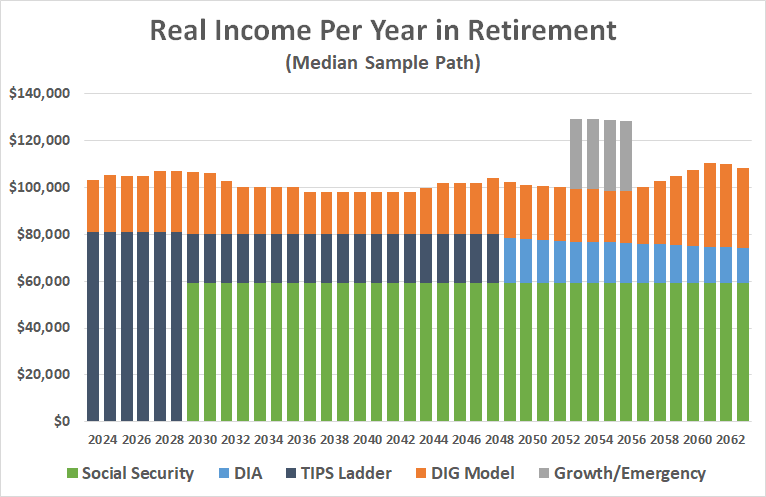

The “4% Rule” and “Fixed Percentage Rule” are opposites…but both involve risk, including a scary beast call “sequence-of-returns” risk.

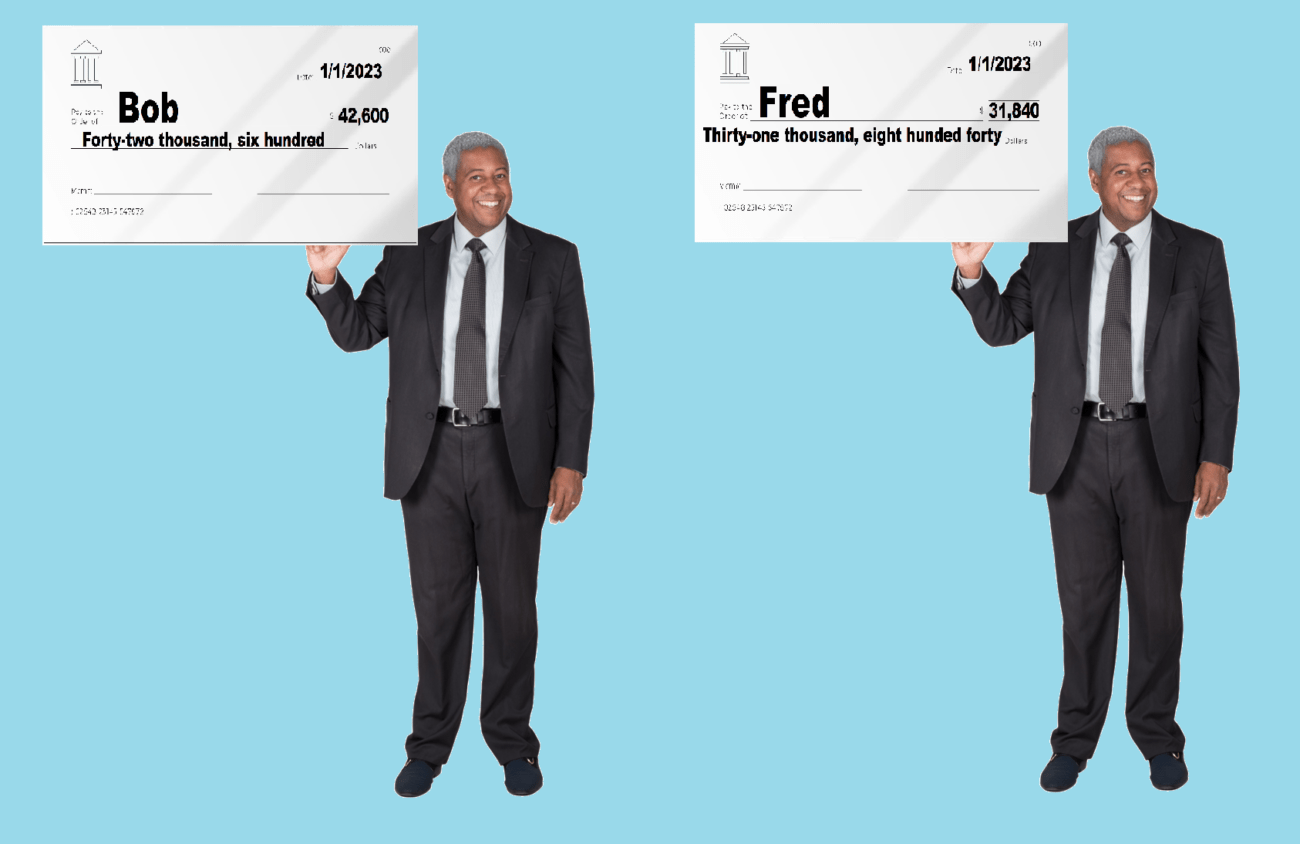

As “Bob and Fred’s Excellent Adventure” resumes, they hop in a time machine to try a completely opposite retirement income strategy. Does it wok better?

Let’s dig further into the facts and foibles of the 4% rule, as a launchpad for a broader discussion about retirement income.

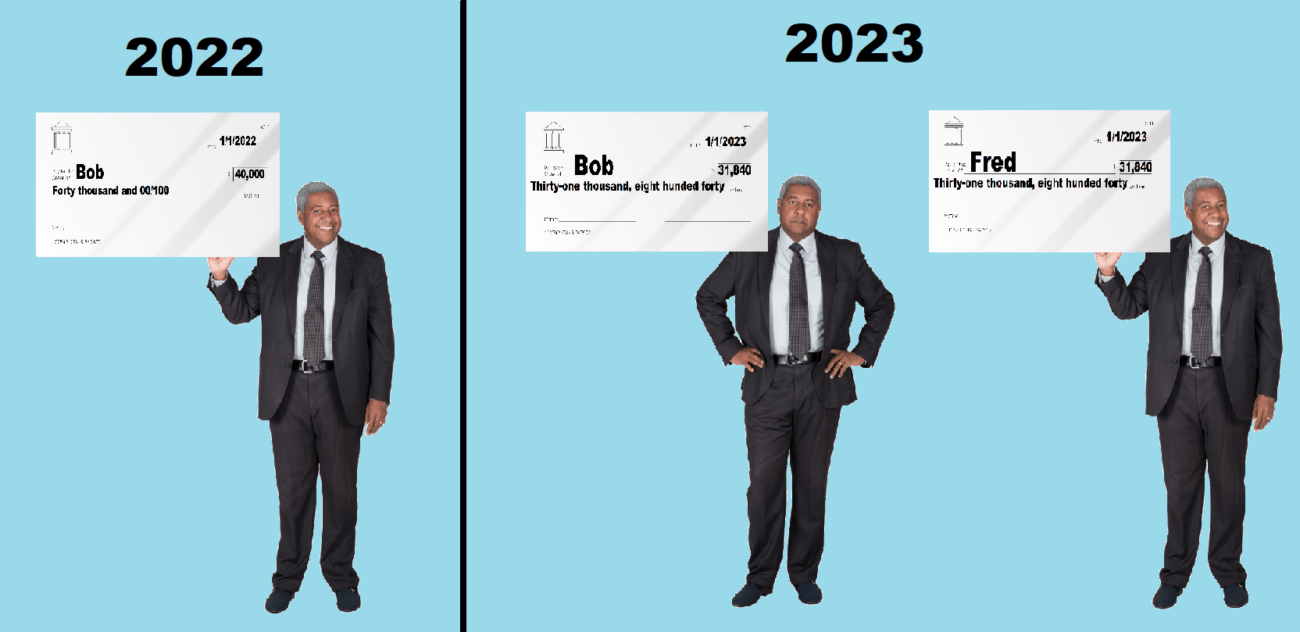

Twin brothers, same age, same assets, same everything…but one has a “safe withdrawal rate” 34% larger than the other?! Find out how that (could have) happened as Round Table’s latest article kicks off our series on retirement income.

SPACs, Memes, NFTs… The investing world had no shortage of “hot dot” investments that grew rather startlingly less hot in 2022. See our thoughts on “hot dot” (or not) investing.

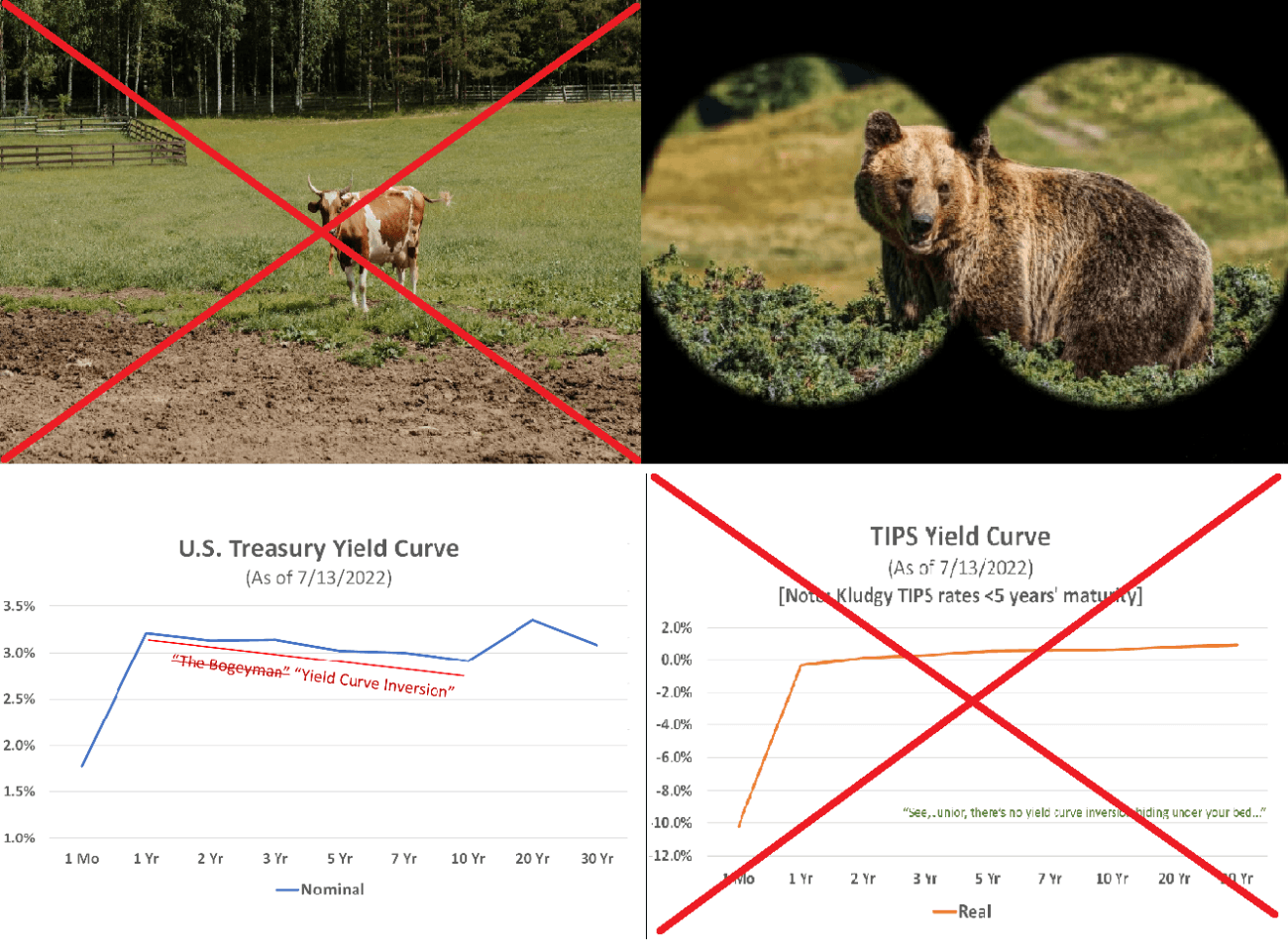

We published earlier articles noting (1) the current bear market didn’t exist in monthly data and (2) the current yield curve inversion didn’t exist in TIPS data. Neither of those observations is still true.