Empower your wealth,

Live life to the fullest

Round Table Investment Strategies is fee-only investment advisor firm held to a fiduciary standard.

Strategic Financial Planning

Our process starts with getting to know you.

Your background, life goals, and financial circumstances are unique, and your financial plan should be uniquely tailored to match. Our goal is to act like the quarterback for your finances, pulling the various elements of your financial life into a coordinated whole.

You have worked hard to build your wealth. We can help you devise a plan to put it to work.

A holistic approach to disciplines like investing, tax management, budgeting, cash management, retirement planning, charitable giving strategies, and estate planning can amplify the benefits that you, your loved ones, and the causes you hold dear derive from your wealth. To assist in the development of a holistic financial plan, we have developed a web-based software system around Round Table’s proprietary “Keep It Simple Financial Plan” methodology. Learn more about the KIS Plan technology here.

We find the balance between “Help me understand” and “Just take care of it for me”

We love to help expedite your personal education in the complexities of personal finance, but it is also our pleasure to take the legwork of managing your wealth off your hands. We seek to work with you in whatever way best enables you to focus on what matters to you.

Investment Management

A portfolio crafted to serve your financial plan.

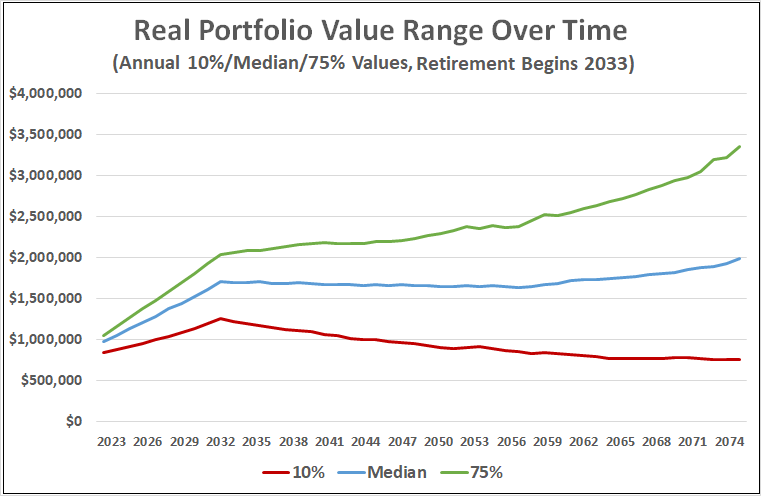

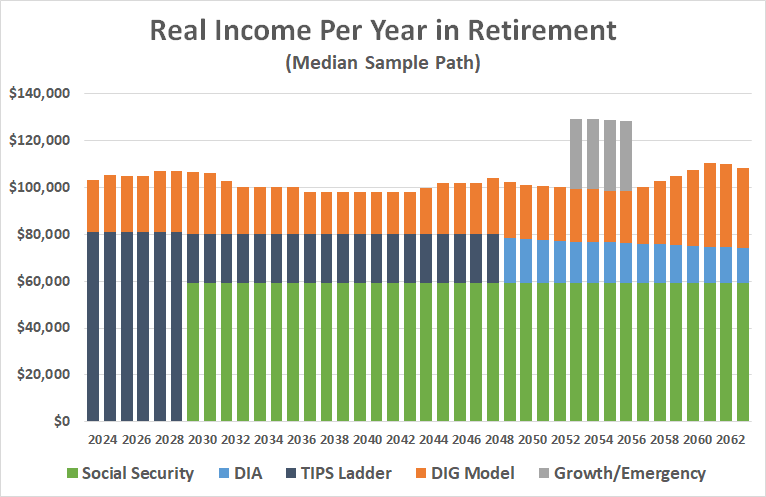

Decisions like what kinds of investments to make and how much risk to take should not exist in isolation. Rather, your goals and aspirations, your income needs, the flexibility of your circumstances, and the expected timing of various life events (retirement, kids’ college, major purchases, etc.) are some of the important variables we strive to understand and integrate into our portfolio construction process. Round Table’s sophisticated “Layer Cake” retirement income and investment model exemplifies this philosophy.

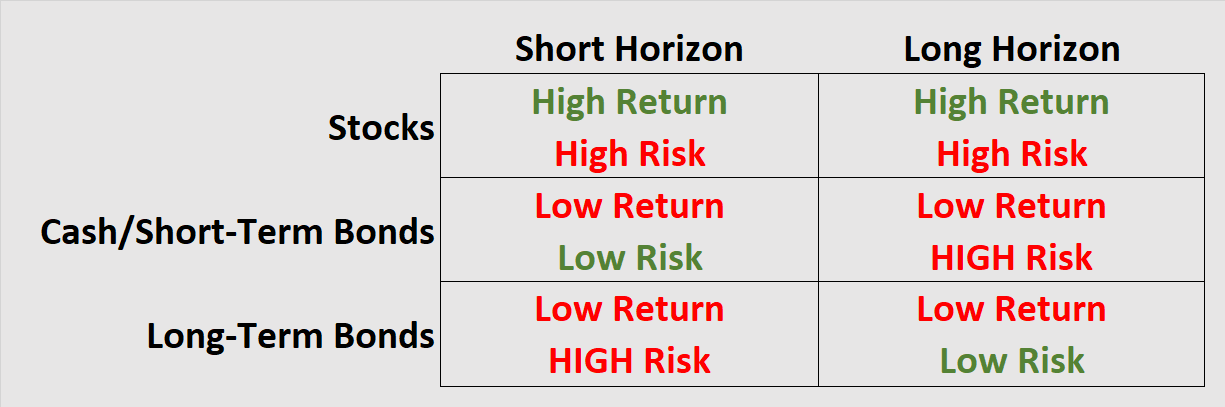

Risk and return are related, but not all risks are worth taking.

We use the science of capital markets to eliminate unrewarded risks through broad diversification and the intelligent combination of various asset classes. Concepts from fields like lifecycle finance yield insights into which kinds of investments are appropriate to the pursuit of your distinct goals.

We take a selective and measured approach to pursuing drivers of investment returns.

We utilize investment products from asset management firms that have both specialized expertise and connections to leading minds in the financial industry and academia.