On Retirement Income, Part 7: How Guaranteed is Guaranteed Income?

Guaranteed income from Social Security, pensions, and annuities can be the bedrock of a retirement income plan. But such guarantees are only useful if the guarantors can be trusted!

Guaranteed income from Social Security, pensions, and annuities can be the bedrock of a retirement income plan. But such guarantees are only useful if the guarantors can be trusted!

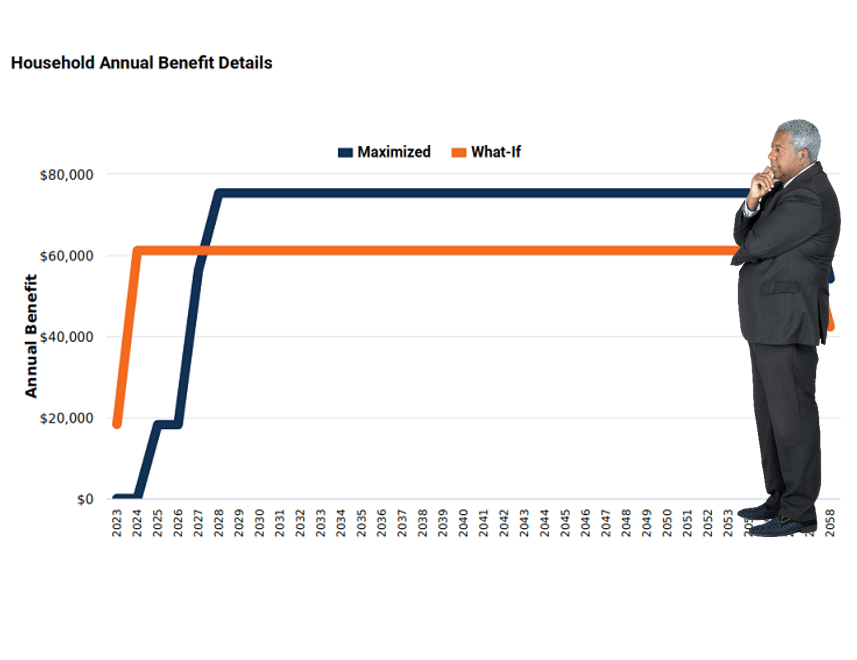

One of the most significant facets of “goals-based investing” is matching inflexible spending needs with secure income sources, most notably Social Security.

The headline rate on I-Bonds has fallen below T-Bills, CDs, etc. Round Table presents a Kenny Rogers-inspired framework for considering your I-Bond options now.

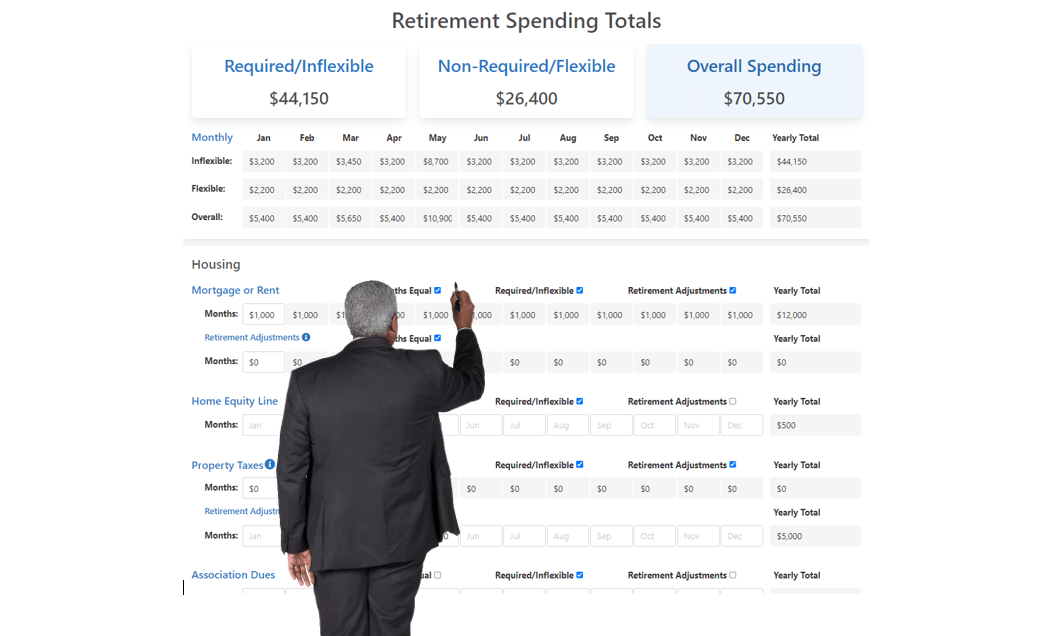

At Round Table, we practice “true goals-based investing.” Our process starts with understanding our clients’ goals, needs, fears, and broader financial picture.

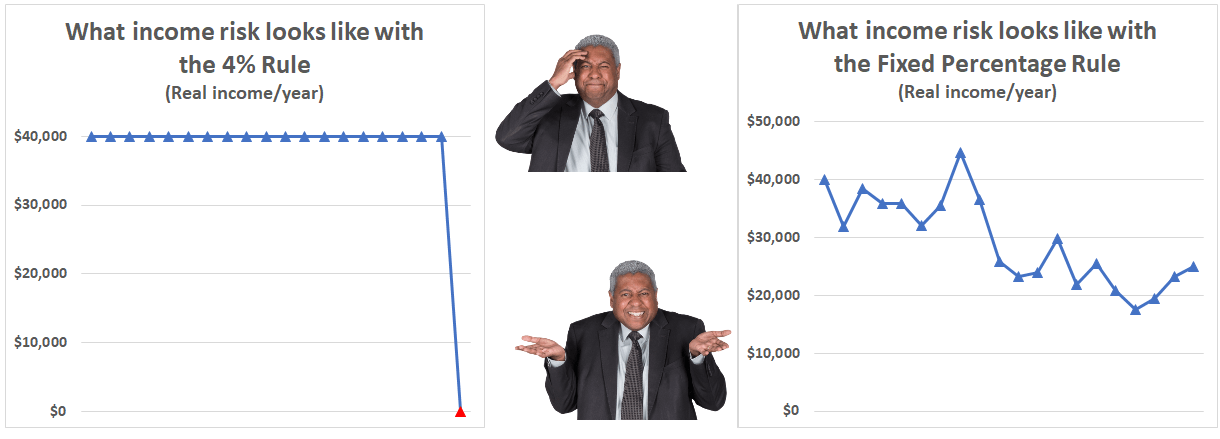

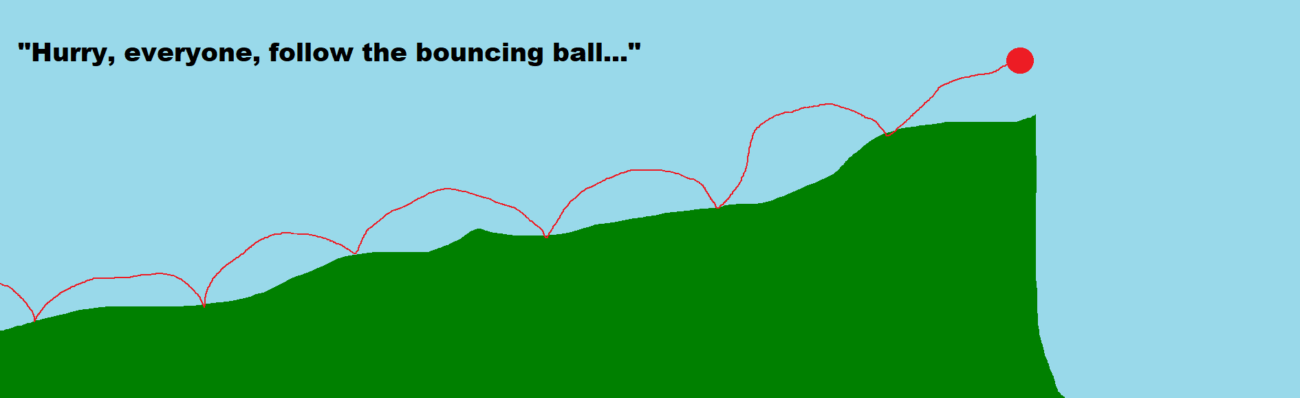

The “4% Rule” and “Fixed Percentage Rule” are opposites…but both involve risk, including a scary beast call “sequence-of-returns” risk.

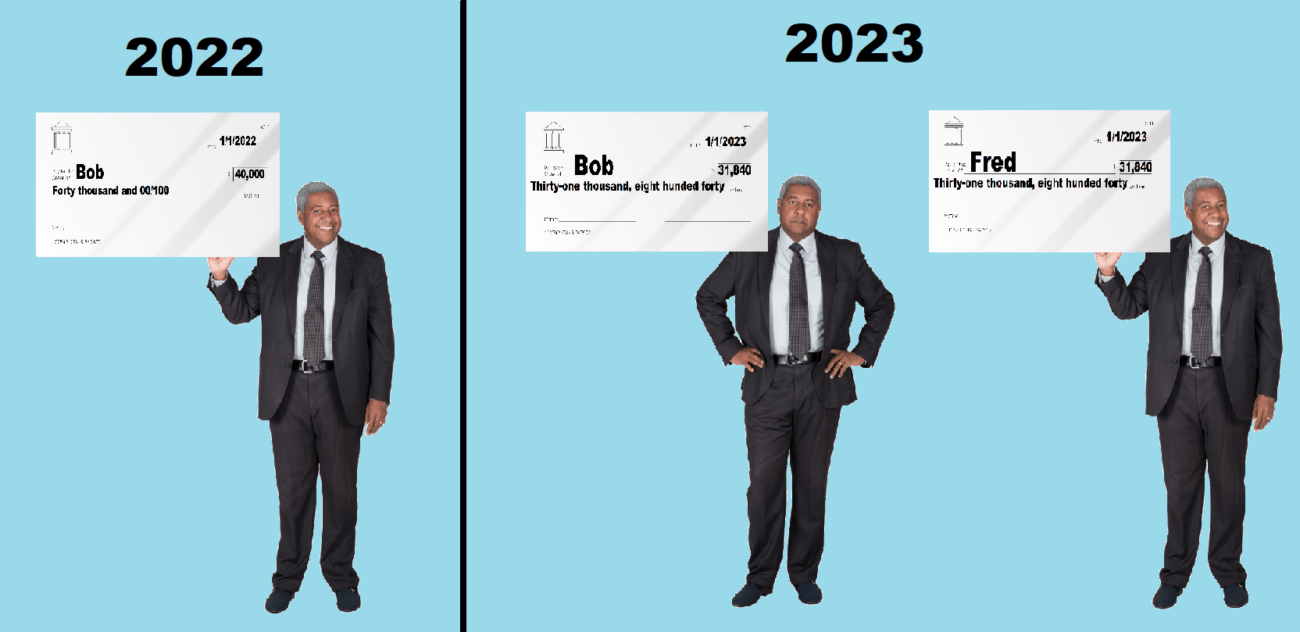

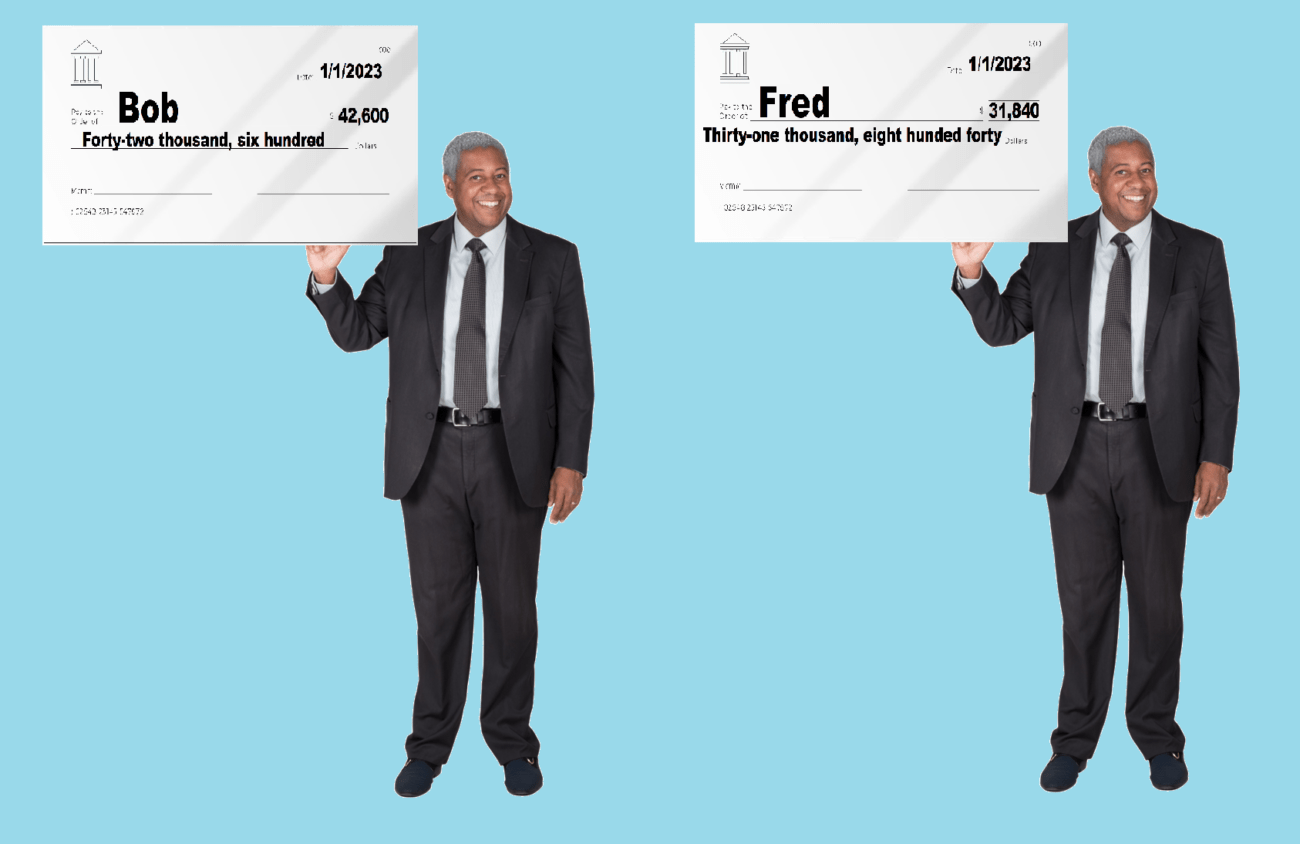

As “Bob and Fred’s Excellent Adventure” resumes, they hop in a time machine to try a completely opposite retirement income strategy. Does it wok better?

Let’s dig further into the facts and foibles of the 4% rule, as a launchpad for a broader discussion about retirement income.

Twin brothers, same age, same assets, same everything…but one has a “safe withdrawal rate” 34% larger than the other?! Find out how that (could have) happened as Round Table’s latest article kicks off our series on retirement income.

SPACs, Memes, NFTs… The investing world had no shortage of “hot dot” investments that grew rather startlingly less hot in 2022. See our thoughts on “hot dot” (or not) investing.

A CPI-adjusted life annuity with a cash value…the stuff dreams are made of!